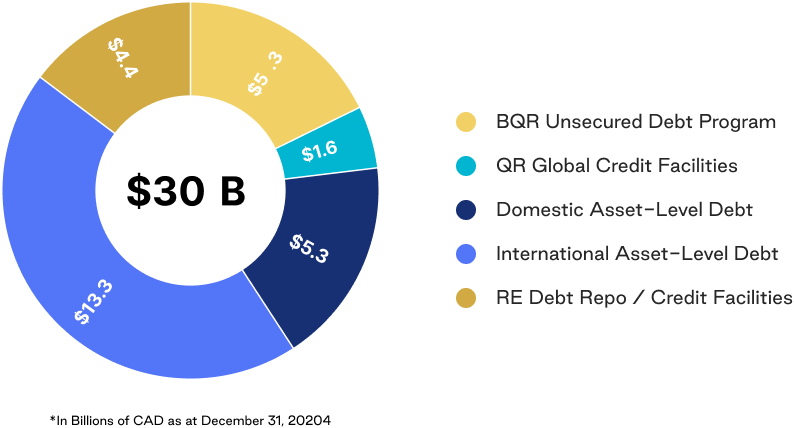

Our financing strategy ensures liquidity to meet present and future investment needs, focusing on optimizing our credit capacity and cost of capital. We leverage both unsecured and secured financing to manage and diversify funding sources across our Global Asset Pools.

QuadReal issues both conventional and green bonds in Canada through its financing entity BCI QuadReal Realty (BQR), which holds an AA (low) rating from Morningstar DBRS.

For short-term liquidity, BQR uses a $2.5 billion Commercial Paper program to support its domestic and global working capital requirements which is backstopped by a $2.5 billion sustainability-linked loan revolver and is the largest in the Canadian real estate market.

Learn more about our Green Bond Framework.

QuadReal maintains various committed syndicated and bilateral credit agreements with global lenders that provide general liquidity, bridge financing, and letters of credit support, with the ability to fund in CAD, USD, GBP, EUR, AUD, and JPY currencies.

QuadReal utilizes various types of asset level financing for its Canadian multifamily, industrial, office and development assets. These include land loans, construction financing, term facilities, and CMHC mortgages.

QuadReal utilizes various types of asset level financing across its U.S., Europe, and Asia-Pacific portfolios with more than 100 global lending relationships.

QuadReal utilizes various Canadian and U.S. repurchase agreements or credit facilities to support its global real estate debt portfolio.

BCI QuadReal Realty (BQR) is our primary financing entity, holding over $17 billion of high quality Canadian residential, industrial, office, and retail assets.

Credit Rating AA (Low)

| Issuer | Issue date | Green bond | Outstanding | Coupon | Maturity |

|---|---|---|---|---|---|

| bcIMC Realty Corp | March 2017 | C$500 million | 3.000% | March 31, 2027 | |

| BCI QuadReal Realty | July 2020 | C$350 million | 1.747% | July 24, 2030 | |

| BCI QuadReal Realty | February 2021 | C$400 million | 1.073% | February 4, 2026 | |

| BCI QuadReal Realty | February 2022 | C$400 million | 2.551% | June 24, 2026 | |

| BCI QuadReal Realty | July 2024 | C$400 million | 4.160% | July 31, 2027 | |

| BCI QuadReal Realty | March 2025 | C$350 million | 3.281% | March 14, 2028 |

Try clearing filters or choosing a different category.